Things To Consider When You Order Checks

When you order checks, you need to keep in mind not only the price but also laser check security. Many companies offer creation of personalized checks with custom design. They can be pre-printed with information that company requires. They can be also produced as blank checks. In this case the necessary check attributes will be printed on the blank laser forms using check printing software. There are many packages available on the market ranging in price, security features, and integration with ERP system.

According to Federal Reserve Payments Study, consumer and business checks account for large amount of unauthorized transactions. In 2013 92% of organizations that order checks used them when paying their major vendor/suppliers. 52% of organizations have experienced check fraud in the past year. This was the second highest level of fraud after credit card transactions.

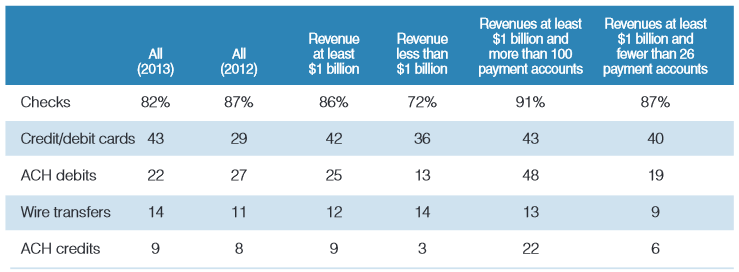

The chart shows percent of organizations subject to attempt payment fraud in 2013.

Many Chief Information Security Officers are concerned with check security, when companies order checks. They can provide recommendations to decision makers for check printing software. There is a way to reduce the loss from check fraud that in 2014 accounted for average $23,100 per company.

In growing companies many internal processes become decentralized, managed from different software packages. They use different supplies and order checks from different sources. Branches may have different procedures, different payment systems, and multiple bank accounts. There is a huge potential savings in centralizing payments operations and companies can increase security and efficiency of payment processing. One department can manage payments with combination of check writing software and electronic ACH payments, reducing labor cost, order checks cost and increasing efficiency. Check fraud can be prevented when payment operations are in the centralized location.

81% of organizations use “positive pay” as a prevention method of check fraud. Positive Pay software allows a customer to generate and transmit a file to their bank referencing the checks that have been issued with check printing software. The bank then takes responsibility to cash only those checks referenced in the Positive Pay file. Other popular methods of guarding against check fraud include “daily reconciliation” and “segregation of accounts.”

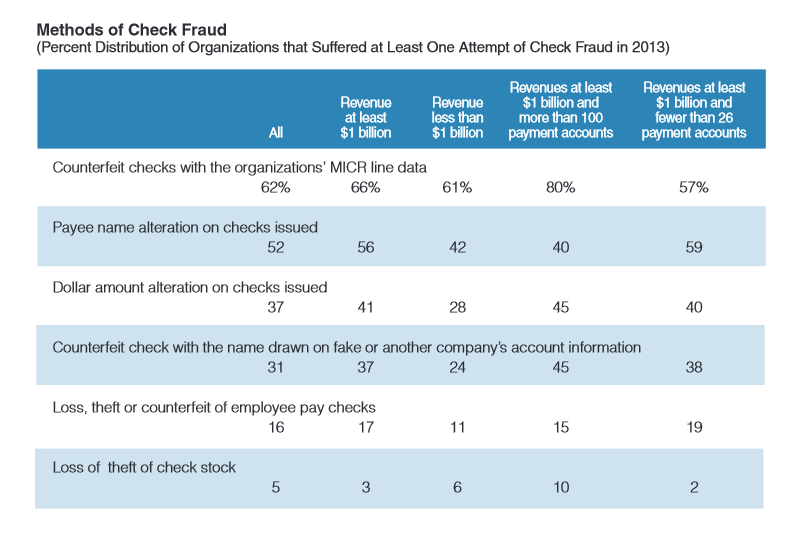

The most common check fraud that occurred in 62% of organizations in 2013 was counterfeiting by altering the MICR line that is printed on a check. Another wide-spread fraud technique involved the alteration of the payee name on issued checks. Both can be avoided with the use of check printing software saving companies money and headache.

Many of the above cases of check fraud can be prevented with the use of secure check stock and secure check printing software. When you order checks, pay attention to security elements incorporated in the check paper. Go for blank laser check paper stock that meets and exceeds the requirements for the Check 21 Standard. It can be used for processing accounts payable, payroll, dividends, refunds, claims and other secure documents.

Order checks with the following security features:

- Micro Printing. The small micro print for the border line on the check and the endorsement. The words are readable when magnified. The same security feature is also used on United States Currency. The wording is no longer legible when check is copied.

- Signature and Amount area. Both are printed with different pantograph backgrounds from the rest of the check. This patented use of multiple pantograph designs produces VOIDs when the check is copied.

- There are many types of watermarks that can be printed in front or on the back of the checks. They contain a warning that checks cannot be photocopied.

- Order checks with fluorescent fibers on the back that will intensify under black light.

- Chemical protection. The paper reacts to chemical alteration and stain can appear.

- Padlock Symbol is a sign of security. It directs to the back of the check where safety features are listed. The use of padlock is authorized by the Check Payment Systems Association. Padlock icon can be pre-printed on checks or can be dynamically printed when using software for check printing.

Grades of papers commonly used for the preparation of payment documents include bond, forms paper, carbonless paper, various safety papers, and special cheque papers including recycled paper. Order checks from established companies and pay attention to all the security features and check compliance. This will prevent many fraud attempts and save you thousands of dollars.

Read full report including survey on check fraud and preventive measures.