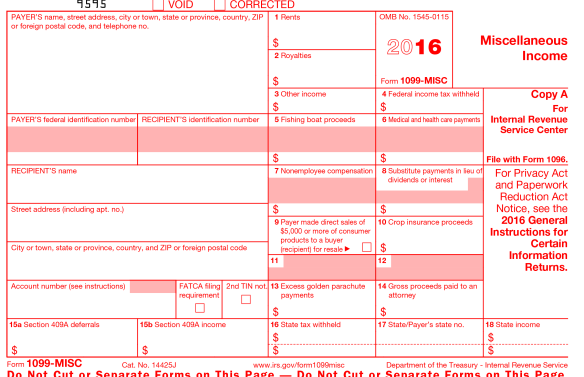

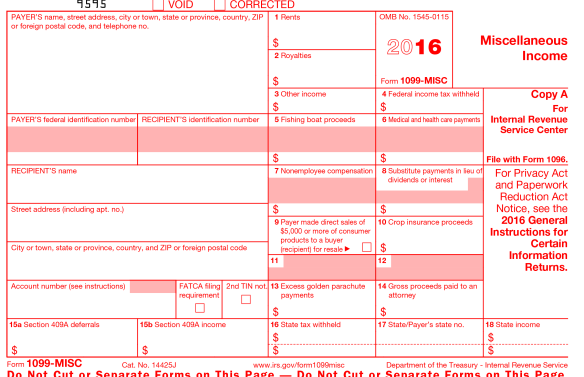

Form 1099 for independent contractors

Form 1099 is used to report various types of income paid to independent contractors which are non-employees of the company. It is required that company prepares four copies of Form 1099: one for the payer, one for the payee, one for the IRS, and one for the State Tax Department, if it is required. Payer also has to submit Form 1096 that represents a summary of form 1099 being sent to the IRS. This form must be printed using the special red pre-printed form, or electronic software that is authorized by IRS for tax filings.

Printech offers sets of form 1099

Standard Set of 100 recipients. The 1099 Misc. set contains 50 sheets of each Copies A, B, C (C,2).

Standard Set of 100 recipients. The 1099 R contains 50 sheets of each Copies A, B, C, D (1,2). The standard set is available without envelopes and is also available with 100 regular envelopes or 100 Self Seal envelopes.

Mini Set of 50 recipients contains 25 sheets of each Copies A, B, C,(C,2). The set is available with 50 regular envelopes or 50 Self- Seal envelopes.

Micro Set of 20 recipients contains 10 sheets of copies A, B, C, C and is available with 20 Self- Seal envelopes.

Contact Printech to find out about other sets of Form 1099 available. Printech consultants can choose a package to satisfy your company needs, regardless of whether you mail the forms or file electronically. Laser Form 1099 for electronic filing require software to print information.

CheckPlusCFO secure payment processing software can automate the process. All he payments made to a specific contractor over the year can be summarized and printed with proper taxes and deductions indicated.

Pressure seal Form 1099 MISC and 1099R Forms are available as 11” V-fold and 14 “ EZ-fold with printed and blank formats.