Trinidad and Tobago is one of the largest economies in the Caribbean region. Trinidad payment system has developed overtime allowing to conduct business with international companies. It is a high-income island economy with a population of 1.4 million and GDP of $27.7 billion. The country’s wealth is attributed to its large reserves and exploitation of oil and natural gas. The country supplies manufactured goods, cement and has evolved into a financial hub for the region with Trinidad payment system being one of the most developed in the Caribbean region. It is considered a high-income country and an area with high potential growth.

The financial services industry in Trinidad and Tobago is represented by eight commercial banks operating in the region and a network of 123 branches throughout.

The Central Bank of Trinidad and Tobago (CBTT) regulates the banking and insurance industry with 25 insurance companies registered. It provides guidelines and requirements for the businesses that conduct business in the country.

Financial sector and Trinidad payment system is fast developing and requires investment in more efficient technology to automate disbursement of payments and to process them in a secure fashion. Checks and ACH are the common methods of payment in the B2B sector.

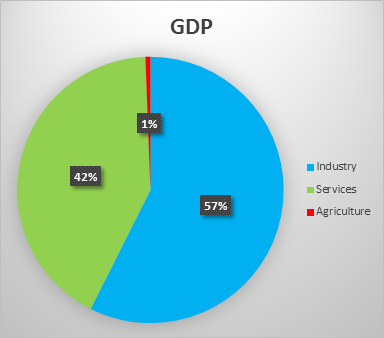

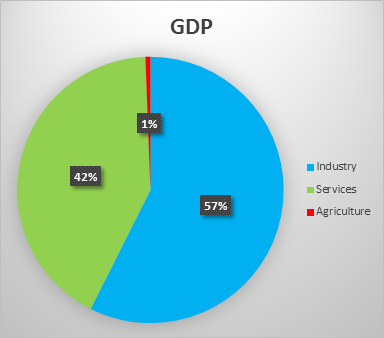

Trinidad payment system supports services sector

- banks

- wholesale and retail trade

- hotels and restaurants

- transport

- government

- financial

- professional

- education

- health care

- real estate services

Trinidad payment system supports Industry Sector

Industry Sector accounts for 57.4% of GDP and includes:

- manufacturing

- mining

- construction

- utilities

Trinidad payment system & CheckPlusCFO

Printech Global Secure Payment Solutions has consulted major financial players and insurance companies to improve Trinidad payment system. Some of the main banks that regulate financial industry have been using CheckPlusCFO secure payment solution from Printech since 2010. Other clients include government organizations and insurance companies that conduct business in the country. Trinidad payment system receives benefits from using check printing and electronic payment software from Printech to streamline payment processing operations and provide secure and efficient ways to process transactions.

The all-in-one secure payment solution includes CheckPlusCFO check printing and electronic ACH software, laser secure checks with multiple protection features, MICR printers and MICR toner cartridges. CheckPlusCFO allows the end user to print checks from multiple banks, multiple bank accounts in different currencies and is customizable to each organizations’ requirements and business rules. Checks look professional with company logos and can be auto-signed based on company policy and security controls. The software allows easy reconciliation of payments with banks, comprehensive reporting and log of user activity. Positive Pay features allow the end user to send files to the bank, confirm checks issued and verify discrepancy.

We recommend a free web demonstration that guides you through the payment process. Our experienced consultants can review and analyze your business requirements and recommend a solution that is the best fit for your organization.

Schedule a demo with one of our specialists today and improve payment operations in your company.